Self-insured carriers:

Horizon Level Select is for employers with 15 to 99 employees. Three plan options: OMNIA, Advantage EPO & Direct Access - includes Rx & wellness benefits.

With level-funding plans, employers:

• Pay the actual claims, plus an administrative fee

• Receive a portion of excess funds as a refund

• Built-in protection with stop-loss coverage.

• Include individual and aggregate stop-loss protection

Cost-saving opportunities. If claims are lower than expected, groups will receive 50% reimbursement of the surplus — so

a healthier employees means cost savings.

BlueCard® coverage. Get in-network out-of-state coverage

Health Savings Account (HSA). With a high-deductible health plan, covered members enjoy pretax savings they can use to pay for qualified medical expenses.

United Healthcare Level Funded plans are available to employers with 2-99 and 100-300 employees. Freedom, Liberty and Metro networks available.

National network – UHC Choice/Choice Plus, UHC Navigate®/UHC Charter® or UHCCore/Core Essential.

• $0 Primary Care Physician Copays for Kids program*.

• Monthly employer claims and utlization reporting.

• Choice of Prescription Drug Lists – Advantage or Essential.

• Surplus refund for the plan sponsor if medical claims are lower than expected.

• 24/7 access to virtual care providers with Virtual Visits and Healthiest You.

• Simplified contract - no back-end claim exposure for the plan sponsor; no terminal liability requirements or deficit carry-forward.

• Low individual and aggregate attachment levels to limit claim exposure. Larger stop loss for larger groups

• Individual Stop Loss up to $100,000 (varies by state)

• Aggregate Stop Loss of 110%, 115%, 120% and 125%

Aetna Funding Advantage built for small businesses. It has one stable monthly payment, the opportunity to get money back when claims are lower than expected and the protection of stop-loss insurance when claims are higher than expected.

Aetna AFA offers 54 health plan options, health/wellness programs, digital benefits admin and broad & enhanced local network options.

Employers must contribute 50% to the total cost of coverage of the lowest cost plan option or 50% of employee only contributions for the cost of coverage of the lowest cost plan option. Depending on the # of eligible employees your organizations has, Aetna requires a certain # of those employees to enroll.. Once you have 10 eligible employees, a minimum of 50% of eligible employees must enroll in the plan.

Allstate Benefits

Level-funding and Reference-based price plan options for 2-50 employees offer national networks with Aetna ASA and Cigna PPO.

- Refund always returned upon renewal or termination

- 100% surplus option

- Will enroll: 1099 groups, Husband/wife groups and Owners-only enroll groups

Level-Funding options and Reference-Based pricing

options:

Core Value: A reference-based pricing plan that pays based on a multiple of the Medicare reimbursement rate, delivering great

savings potential.

Core Value Access: Core Value Access gives clients the savings of a reference-based pricing plan with the added benefit of access to a network for physicians.

Core Value Flex: This option allows employers to experience the savings of our Core Value plan with the added flexibility of switching to a PPO network mid-year, without a change in your

clients’ monthly payment.

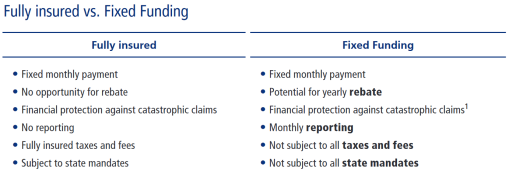

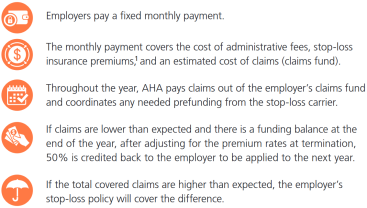

Amerihealth Fixed-Funding (5+ Employees Enrolling)

The healthcare industry is changing fast. At AmeriHealth, we have the people, processes, and technology to help you access the best healthcare resources for you and your

employees.

Cost containment and customization. Let us add value to your business by leveraging our knowledge and self-funded expertise. We’ll give you the information and support you need with self-funding that helps deliver more cost-effective health benefit plans and help improve the quality of benefits to your employees.